COSTA MESA, Calif., June 28, 2018 /PRNewswire/ — Current estimates suggest that women now control 51% of total U.S. wealth,1 yet despite the significant attention that fact has received within the industry, women still represent just 16% of all financial advisors.2 One key to closing this gap is creating more advocates among existing female advisors, who are best positioned to influence other women to enter the industry.

J.D. Power 2018 U.S. Financial Advisor Satisfaction Study

J.D. Power 2018 U.S. Financial Advisor Satisfaction Study

The good news is that, according to the J.D. Power 2018 U.S. Financial Advisor Satisfaction Study,SM released today, female financial advisors are generally more satisfied and loyal to their firm than their male counterparts, but they do have some unique pain points that firms that want to be leaders in this area will need to address.

“The wealth management industry clearly recognizes that aligning the gender mix of advisors with the shifting demographics of investors is critical for their success,” said Mike Foy, Director of the Wealth Management Practice at J.D. Power. “But firms that want to be leaders in attracting and retaining top female talent need to differentiate on recognizing and addressing those areas that women’s perceptions and priorities may differ from men’s.”

Following are some key findings of the 2018 study:

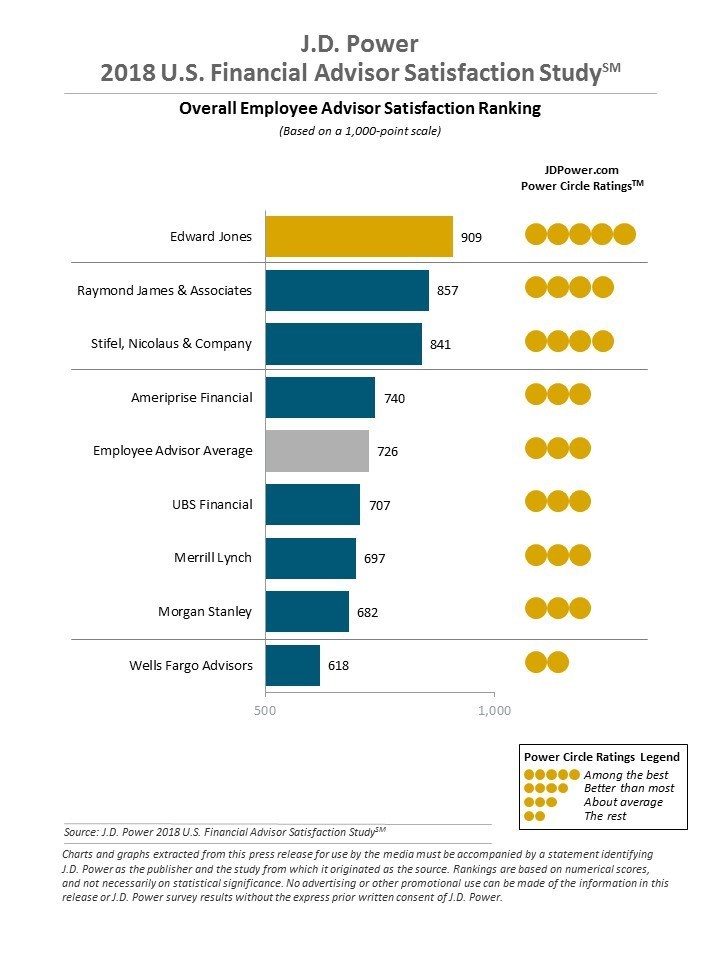

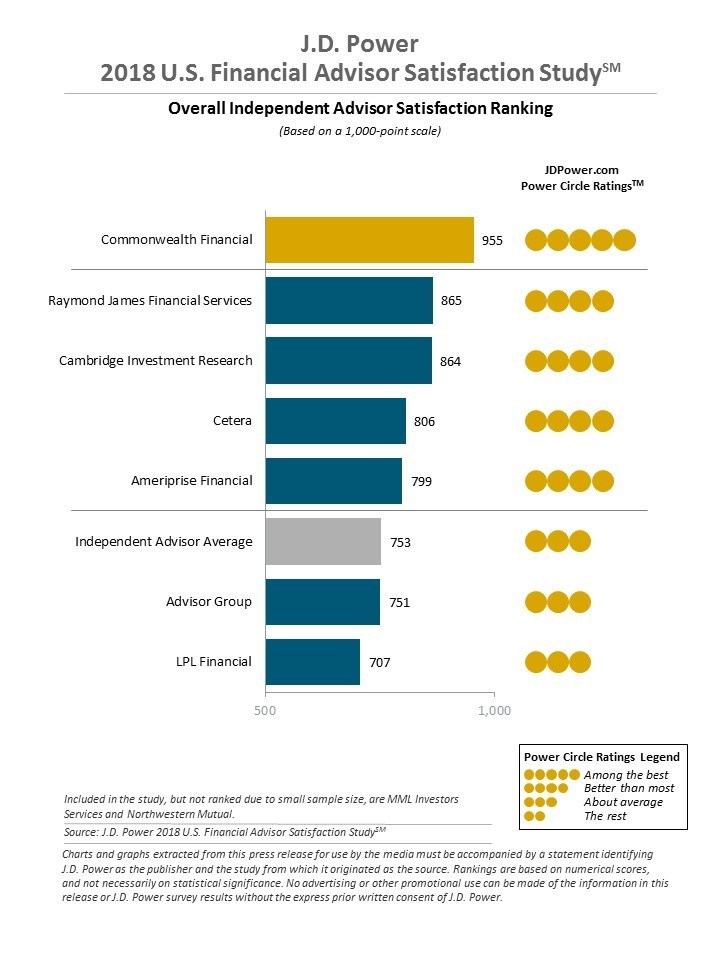

- Overall advisor satisfaction with firms is improving: Overall satisfaction averages 726 (on a 1,000-point scale) among employee advisors, up 7 points from 2017. Satisfaction among independent advisors averages 753, up 1 point from 2017.

- Female advisors more satisfied and loyal, bigger brand advocates: The average overall satisfaction score among female advisors is 786 among employee advisors, 59 points higher than among their male counterparts. Among independent advisors, overall satisfaction among women is 793, which is 39 points higher than among male advisors. Female advisors also are more likely than male advisors to say they “definitely will” remain at the same firm over the next 1-2 years (68% vs. 56%, respectively) and are more likely to say they “definitely will” recommend their firm to others (60% vs. 50%).

- Areas where female advisors are less satisfied than male advisors: While female advisors provide higher ratings in the study for their firms than do male advisors, there are a few areas where they underperform. Firms interested in being an attractive destination for female financial advisors should be aware that:

-

- Women are significantly more likely than men to say they do not have an appropriate work/life balance (30% vs. 22%, respectively). Nine of 10 (90%) women who do have that balance say they “definitely will” recommend their firm, compared with 68% of those who do not.

- Women are less likely than men to say they “completely” understand their compensation (60% vs. 66%, respectively) and less likely to believe it reflects their job performance (60% vs. 68%).

- Women are less likely than men to believe mentoring programs are effective (44% vs. 53%, respectively).

Study Rankings

Among employee advisors, Edward Jones ranks highest in overall satisfaction with a score of 909. Raymond James & Associates (857) ranks second and Stifel, Nicolaus & Company (841) ranks third.

Among independent advisors, Commonwealth Financial ranks highest in overall satisfaction with a score of 955. Raymond James Financial (865) ranks second and Cambridge Investment Research (864) ranks third.

The study measures satisfaction among both employee advisors (those who are employed by an investment services firm) and independent advisors (those who are affiliated with a broker-dealer but operate independently) based on seven key factors (in alphabetical order): client support; compensation; firm leadership; operational support; problem resolution; professional development; and technology support. Satisfaction is measured on a 1,000-point scale.

The study is based on responses from 3,227 employee and independent financial advisors and was fielded in January-April 2018. The mean tenure for female advisors at their current firms is 18 years and the mean tenure for male advisors at their current firms is 20 years.

GOT NEWS? click here

Google News, Bing News, Yahoo News, 200+ publications

For more information about the U.S. Financial Advisor Satisfaction Study, visit http://www.jdpower.com/resource/us-financial-advisor-satisfaction-study.

See the online press release at http://www.jdpower.com/pr-id/2018095.

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. These capabilities enable J.D. Power to help its clients drive customer satisfaction, growth and profitability. Established in 1968, J.D. Power is headquartered in Costa Mesa, Calif., and has offices serving North/South America, Asia Pacific and Europe. J.D. Power is a portfolio company of XIO Group, a global alternative investments and private equity firm headquartered in London, and is led by its four founders: Athene Li, Joseph Pacini, Murphy Qiao and Carsten Geyer.

Media Relations Contacts

Geno Effler; Costa Mesa, Calif.; 714-621-6224; [email protected]

John Roderick; St. James, N.Y.; 631-584-2200; [email protected]

About J.D. Power and Advertising/Promotional Rules www.jdpower.com/about-us/press-release-info

1https://www.bmo.com/privatebank/pdf/Q1-2015-Wealth-Institute-Report-Financial-Concerns-of-Women.pdf

2https://www.thinkadvisor.com/2017/01/18/only-16-of-advisors-are-women-cerulli/

![]() View original content with multimedia:http://www.prnewswire.com/news-releases/female-financial-advisors-key-to-recruiting-women-into-industry-to-close-gender-gap-300672860.html

View original content with multimedia:http://www.prnewswire.com/news-releases/female-financial-advisors-key-to-recruiting-women-into-industry-to-close-gender-gap-300672860.html

SOURCE J.D. Power